|

| At a press conference in Ottawa beginning at 11 a.m. Wednesday, officials from the central bank, including governor Tiff Macklem, will outline the bank's economic outlook. Image: Bloomberg |

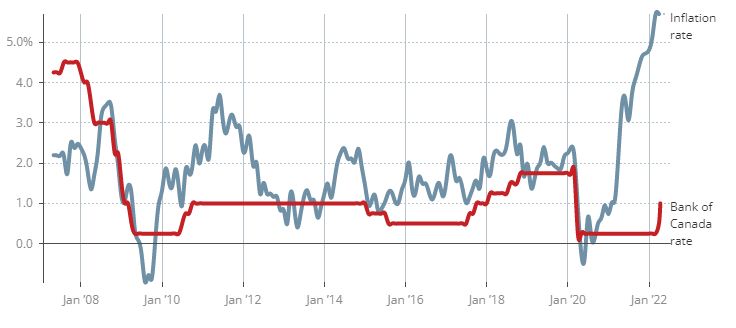

On Wednesday, the Bank of Canada raised its benchmark interest rate by half a percentage point to 1% in its latest effort to control rising inflation. Since 2000, this is the largest one-time increase in the central bank's rate.

The bank's rate influences the rates that Canadian businesses and people pay and receive on things like mortgages, GICs, and savings accounts.

When the epidemic broke out in March of 2020, the bank reduced its rate to just above zero.

Although the move helped the economy weather the extraordinary uncertainty of COVID-19, inflation has risen to its highest level in decades in recent months, causing the central bank to begin unwinding all of that cheap credit.

Inflation is far higher than the bank's target rate.

Because inflation is so high right now, economists foresee a lot more rate hikes.

|

| Chart: Pete Evans/CBC Source: Bloomberg |

The bank has raised its rate for the second time in as many months, making Wednesday's action the bank's first back-to-back rate hike since 2017, as well as its largest single boost since the year 2000.

Economists predicted the move, and with inflation hovering around 6%, they expect more to follow, at least until the central bank's rate rises to 2% — and probably higher.

Officials from the bank, including governor Tiff Macklem, will hold a press conference in Ottawa at 11 a.m. on Wednesday to discuss the bank's decision.

0 Comments

please do not enter any spam link in the comment box