The dramatic rise in mortgage rates has also caused research firms to re-gear their housing forecast models.

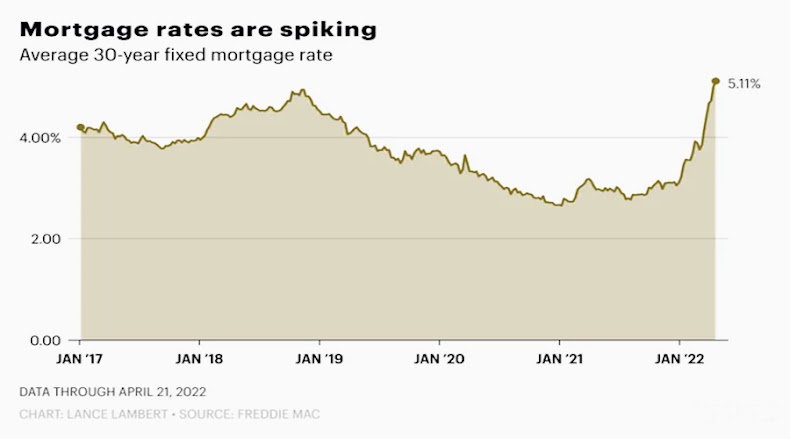

Real estate research firms expected the Federal Reserve to raise interest rates in 2022, but not in this manner. The Mortgage Bankers Association predicted that the average 30-year fixed-rate would rise to 4% this year, while Fannie Mae predicted a 3.3% mortgage rate by the end of the year. We blew past those projections weeks ago.

Real estate analysts are now lowering their home price projections. Zillow analysts revised their estimate on Wednesday, predicting a 14.9 % increase in home prices in the United States between March 2022 and March 2023. This is down 2.9 percentage points from last month when Zillow predicted a 17.8% increase in home prices over the next year.

"Affordability headwinds that have intensified faster than projected, mostly due to strong rises in mortgage rates, are driving the downwardly revised prediction," the Zillow researchers stated. "There are also further threats to the outlook: Inventory levels are near record lows, but they may recover more quickly than expected, lowering the future price and sales volume projections."

|

| US home price growth chart. Image |

It's not surprising that Zillow has decreased its forecast. After all, this rapid rise in rates is putting homebuyers in a serious financial bind. On a $500,000 mortgage, a borrower would owe $2,138 in principal and interest at a 3.11 percent fixed mortgage rate in December. If taken out at a 5.11 percent rate, that payment would rise to $2,718. That's an extra $208,800 over the length of the 30-year loan.

|

| Mortage rate spiking. Image |

If Zillow is correct, home prices will rise another 14.9 percent in the next 12 months, marking another year of record-high home price growth. Home prices have risen by a whopping 19.2% in the last year. Each of those figures is an exception when compared to the average yearly increase in property prices in the United States of 4.6% since 1987.

"Even with the downward correction from last month," the Zillow analysts write, "these estimates would suggest a very competitive housing market in the coming year."

However, not everyone shares Zillow's positivity.

CoreLogic predicts that home prices will slow to a 5% annual growth rate in the coming year. The Mortgage Bankers Association predicts that home prices will rise 4.8 % in the next 12 months, while Fannie Mae predicts that home prices will rise 11.2 % this year and 4.2 % in 2023.

Of course, it's possible that they're all wrong. The Federal Reserve Bank of Dallas has already discovered evidence that home price increase in the United States is outpacing what underlying economic fundamentals would suggest. "Real-time market monitoring finds signals of growing U.S. housing bubble," says the title of the Dallas Fed research.

"Our evidence suggests that the housing market in the United States is behaving unusually for the first time since the early 2000s boom. Certain economic indicators show cause for concern...prices appear to be increasingly out of step with fundamentals, "The Dallas Fed researchers wrote about it.

While CoreLogic believes that a housing market correction is unlikely in the coming year, it does believe that most housing markets across the country are overpriced. For nearly 400 metropolitan statistical areas, the firm calculated a market risk assessment. What was discovered? According to CoreLogic, 65% of regional housing markets in the United States are "overvalued."

Both homebuyers and sellers should take housing forecasts with a grain of salt. Take a look at the housing forecasts issued during the COVID-19 recession. Both Zillow and CoreLogic published economic models in the spring of 2020 predicting that home prices in the United States would fall by the spring of 2021. That price cut never materialized. Instead, the housing market embarked on a historic run that is still ongoing.

p style="text-align: justify;">Source: This story was originally published in Fortune.

0 Comments

please do not enter any spam link in the comment box