Russia is considering easing a key capital-flow control that has pushed the ruble to its highest levels in four years.

Only with rally trying to intimidate budget revenues and exporters, a decision to reduce the share of hard-currency revenue that exporters must convert to rubles to 50% from 80% could be made as soon as this week, according to two people familiar with the situation, who asked to remain anonymous because the plan's information isn't public.

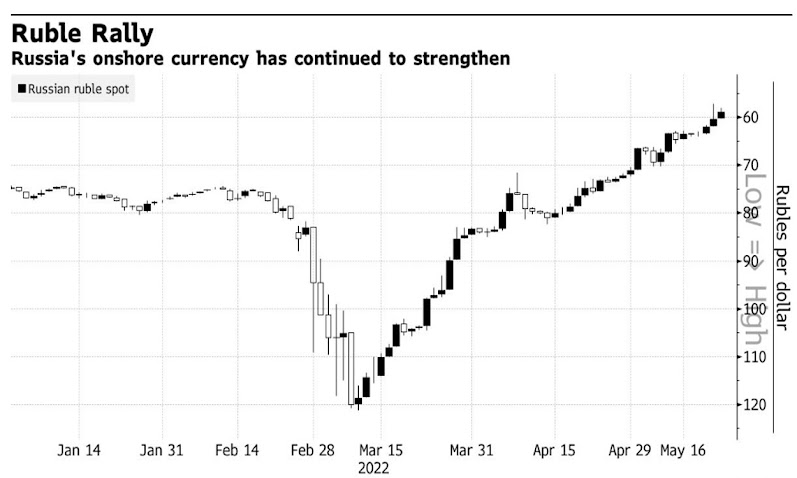

The ruble has recovered 30% against the dollar since Russia's invasion of Ukraine on February 24. Authorities have gradually eased the strict restrictions on foreign-exchange transactions imposed in the days following the invasion to prevent the currency from plummeting.

The restrictions, mixed with a drop in imports as a result of the US and its allies' sweeping sanctions against Russia, effectively eliminated the demand for foreign currency just as supply increased due to high prices for completely unregulated energy exports.

|

| Source: Bloomberg |

The ruble increased to its highest level against the euro in five years on Friday, as more European companies appeared to be complying with President Vladimir Putin's demand that they pay for natural gas in Russian currency.

On Monday morning, the currency increased 2.3 percent to 58.88 against the dollar, continuing its upward trend. The plans to reduce the requirement for exporters to make mandatory sales were first reported by Tass.

Because of sanctions on the central bank's reserves, it is unable to conduct the regular foreign-exchange purchases that it did prior to the invasion.

Burdens of Regulation

Meanwhile, Russia's business lobby has raised concerns about the ruble's rally, announcing the formation of a special working group to monitor the currency situation over the weekend.

The Russian Union of Industrialists and Entrepreneurs said on its website that "excessive regulatory burdens on businesses in the area of currency regulation and control must be avoided."

Ruble's strength is also potentially bad news for the budget, which receives a significant portion of its revenue from energy taxes denominated in foreign currency but spends in rubles.

"The higher the rate, the larger the deficit," Evgeny Kogan, a professor at Moscow's Higher School of Economics, explained. "It also makes things more difficult for exporters, increasing costs and lowering revenue" in ruble terms.

"If this continues for, say, six months, it will be extremely unpleasant," he said, adding that a more "comfortable" rate for the economy would be around 75-80 per dollar.

A request for comment was not immediately returned by the Bank of Russia and the Finance Ministry's press offices.

0 Comments

please do not enter any spam link in the comment box