|

| Elon Musk, the CEO of Tesla, is trying to buy Twitter while also managing multiple businesses. |

Koguan said in a tweet to Tesla's senior director of investor relations, Martin Viecha, that the company should immediately announce plans to buy back $5 billion of Tesla stock this year and $10 billion next year. He also stated that Tesla should use its free cash flow to fund the buyback and that it should not have an impact on the company's existing $18 billion cash reserves. Tesla did not immediately respond to a request for comment from Source.

Agree! @MartinViecha, Tesla must announce immediately and buy back $5 billion of Tesla shares from its free cash flow this year and $10 billion from its free cash flow next year, without effecting its existing $18 billion cash reserves with ZERO debt. https://t.co/Y7p52Ojn8q

— KoGuan Leo (@KoguanLeo) May 19, 2022

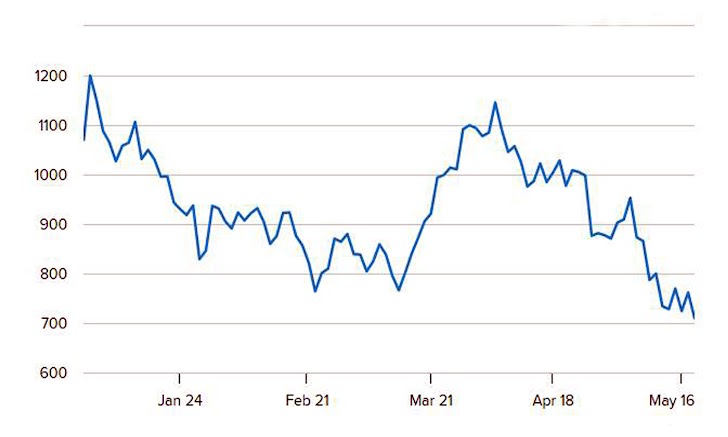

Tesla shares dropped more than 6% on Wednesday as the market fell. The stock has dropped more than 30% this year.

A stock buyback occurs when a public company uses funds to buy its own shares on the open market.

In 2021, buybacks reached an all-time high of $850 billion. Apple managed to buy more of its own shares than any other public company last year, followed by Alphabet and Meta. Last month, Alphabet announced another $70 billion stock buyback.

According to a Forbes report from October, Koguan "bet the house" on Tesla early in the coronavirus outbreak, earning billions by going long on the electric vehicle maker. After selling his stakes in Baidu, Nvidia, China Mobile, and Nio, Koguan reportedly put all in on Tesla.

"I thought of myself as Elon Musk's fanboy," Koguan allegedly remarked. "I believe he is the only person on Earth whom I truly admire."

Musk, the world's richest man on paper, said Tuesday that he's put the Twitter transaction "on hold" until he learns more about the number of bogus or spam accounts on the social media platform.

Due to the recent market sell-off, analysts at Jefferies believe Musk is attempting to drive down the price.

In a research note, equities analyst Brent Thill and equity associate James Heaney said, "Elon Musk's recent comments suggest he is seeking to negotiate a lower bid price."

"We believe Musk is using his inquiry into the percentage of phony TWTR accounts to justify paying less than $54.20 per share." In truth, the NASDAQ COMP is down 25% year to date, and Elon Musk recognizes that he may have overpaid for the asset."

Wedbush analyst and Tesla supporter Dan Ives told on Wednesday that Musk's desire to buy Twitter has created a "huge overhang" on Tesla's shares.

Musk has received a "black eye" in the last several weeks, according to Ives, who claims to have studied Musk for decades.

"I believe his handling of this has been atrocious," Ives said, adding that the incident has "put a bit of a stain" on Tesla's stock.

0 Comments

please do not enter any spam link in the comment box