|

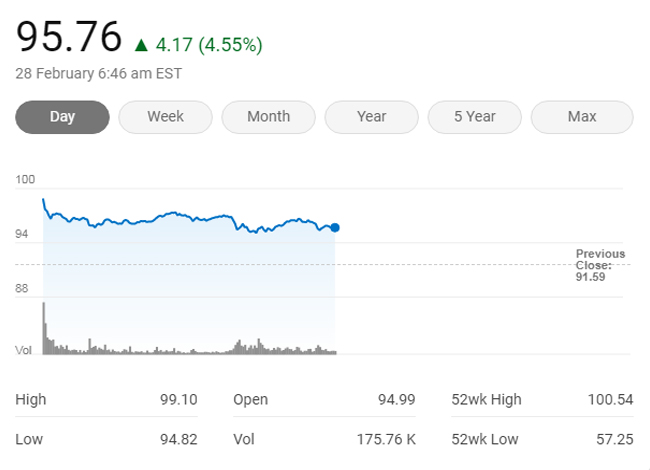

| Oil Price is Rising Image Credit |

After hitting a high of $105.07 a barrel in early trade, Brent crude jumped $4.82, or 4.9 %, to $102.75 by 1028 GMT.

On Monday, the Brent contract for April delivery expires. The most actively traded contract for May delivery was trading at $98.86, up to $4.74.

After touching $99.10 in early trade, U.S. West Texas Intermediate (WTI) oil was up $4.62, or 5%, at $96.21.

"Growing concerns about disruptions in Russian energy supply are driving up oil and gas prices sharply," said Carsten Fritsch, an analyst at Commerzbank.

Russia's exports of all commodities, from oil to grains, are being seriously affected after Western nations placed punitive sanctions on Moscow and removed several Russian banks from the SWIFT international payment system.

Russian crude oil grades which represent around 10% of the global oil supply, have taken a beating in physical markets.

|

| Oil price Today ( At the time of writing) |

"We expect the price of consumed commodities, of which Russia is a major producer, to rise from here," the bank stated.

On Sunday, Russian President Vladimir Putin activated Russia's nuclear deterrence.

Russian forces conquered two minor cities in southern Ukraine, according to Interfax, but met heavy resistance elsewhere.

Ukraine and Russia have begun talks at the Belarusian border, according to a Ukrainian presidential adviser, with the goal of reaching an early cease-fire agreement.

"If there is any progress achieved in this meeting, we will see a big reversal in markets - stocks will climb, the dollar will increase, and oil will fall," said OANDA analyst Jeffrey Halley.

BP, the British oil company, has opted to abandon its Russian oil and gas projects, launching a new front in the West's campaign to isolate Russia's economy. BP is the country's largest foreign investment.

"Sanctions and the evacuation of Western oil corporations are expected to result in lower Russian oil and gas production in the medium to long term," Fritsch added.

The Organization of the Petroleum Exporting Countries (OPEC) and its allies, led by Russia, will meet on March 2. The company is anticipated to stick to its April supply addition target of 400,000 barrels per day (bpd).

Prior to the conference, OPEC+ reduced its prediction for the oil market surplus in 2022 by around 200,000 barrels per day to 1.1 million barrels per day, highlighting market tightness.

h/s: Reuters

0 Comments

please do not enter any spam link in the comment box